Community Outreach

Volunteer Income Tax Assistance (VITA)

Under the advisement of CAE’s Director and Associate Director, the Volunteer Income Tax Assistance site has been in operations since 2009. Through the generous support of our program sponsors – Howard University School of Business, Community Tax Aid DC, Code for America, the Internal Revenue Service, and the National Association of Black Accountants Metro DC Chapter – we were able to continue operations this year.

VITA offers free tax help to people who need assistance in preparing their own tax returns, including:

- People who generally make $57,000 or less

- Persons with disabilities

- Limited English-speaking taxpayers

This year we offered both in-person and virtual prep services. Additionally, we mobilized a drop off site in Ward 5 of Washington, D.C. every Sunday during the tax season. This allowed clients the ability to drop off documents for scanning and upload to our secure platform to participate in the virtual preparation.

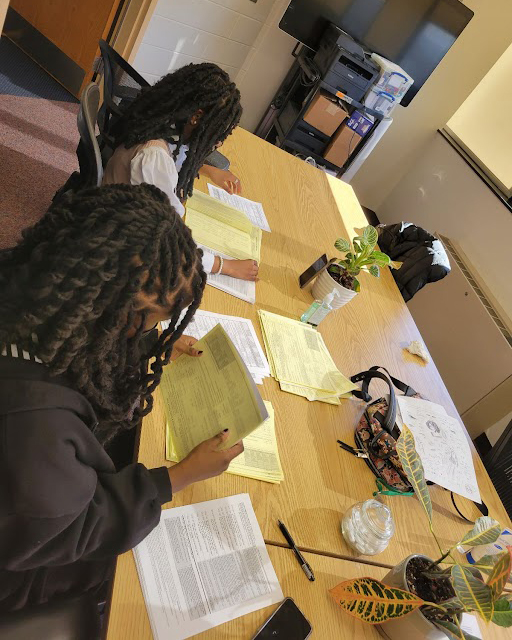

Our volunteers demonstrated their commitment to the program and the services that we provide our low- and moderate-income clients in the community. We certainly could not do what we do without their help. This year, we had a total of 22 volunteers comprised of professors, students, Howard University alumni, and accounting professionals from the community. We completed 182 Federal and 196 State returns which accounted for $434,000 in refunds! We owe our success to our volunteers!!

We extend a special thank you to the Center for Career Excellence for allowing us continued use of their space for in-person tax preparation.

Other Programs

As part of its community outreach, CAE also offers financial literacy and education programming for residents in DC, MD, and VA. We work with residents to guide them through some important things to consider when they receive their tax refunds to help them make the most of the money they expect to receive. We will also provide separate stand-alone workshops and one-on-one financial coaching. Our offerings help residents:

- Recognize the value of using their refunds to contribute to their short- and long-term savings goals.

- Make decisions about how to use their refunds for spending on “must-haves,” saving for the future and spending plans on “nice-to-haves.”

- Get connected to resources like U.S. Savings Bonds, College Savings Accounts, additional tax credits like the Saver’s Credit, Individual Development Account programs and other financial products.